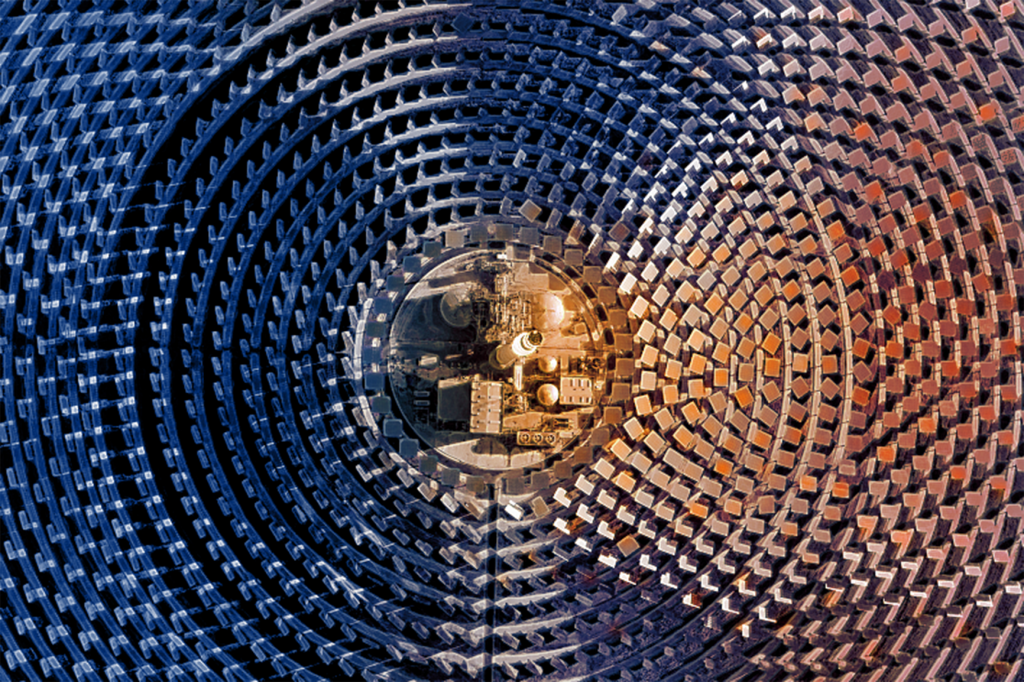

Connecting the Dots on Climate

FFI Solutions empowers institutions with essential insights on risks and opportunities in the evolving climate landscape. Our in-depth research and client-centered approach drive portfolio decarbonization services, sector-specific carbon analytics, and customized climate consulting – supporting smarter decisions in an increasingly complex and interdependent world.

We connect the critical pathways between carbon, capital, and climate.

What We Do

Advisory

For investors seeking to integrate a broad array of climate considerations and technology solutions into their policies and processes. Custom research and consulting services include:

- Bespoke Research

- Climate Action Plan

- Climate Risk Advisory

- Vendor Selection

Research & Analytics

Supporting the evaluation of energy companies, the risks associated with climate change, and the transition to a low-carbon economy. Sector-specific research on:

- Assets

- Investments

- Operations

- Emissions

Our Analytics Platforms & Products

Transition Intelligence

Informed Oil and Gas Investing Decisions for the Energy Transition

Our intelligence platform offers interactive, cloud-based data, metrics, and analytics on 100 of the largest global publicly traded oil and gas reserve owners. Through a flexible and easy-to-use interface, investors can customize evaluations based on their unique beliefs and operational needs.

The Carbon Underground 200® & 500TM

The World’s Top Publicly-Listed Fossil Fuel Reserves Owners

Our in-depth research, rankings and analytics on over 600 global publicly-traded fossil fuel companies provide critical inputs into purpose-driven portfolios, sustainable investment products, and broader ESG integration approaches.

Who We Serve

Asset Owners

- Integrate climate considerations into investments

- Monitor and manage climate-related risks

- Fulfill mandates and reporting requirements

Corporates and Private Equity

- Measure climate exposures

- Discover climate technology solutions

- Conduct solutions due diligence.

Asset Managers

- Develop climate-aligned products

- Customize accounts to meet investor demand

- Engage with corporations on climate issues

Investment Advisors & Consultants

- Allocate capital to climate-aligned strategies

- Conduct climate-focused due diligence

- Monitor and report on climate-related risks